Many times, our bills and fixed expenses don’t quite line up with our income. That’s where the half-payment method can come in handy.

What is the Half-Payment Method?

The Half-Payment Method is a strategy for making additional payments on your debt or large recurring expenses, without putting too much strain on one paycheck. This works well for anyone with a steady, predictable income (ex: paychecks every two weeks).

How does it work?

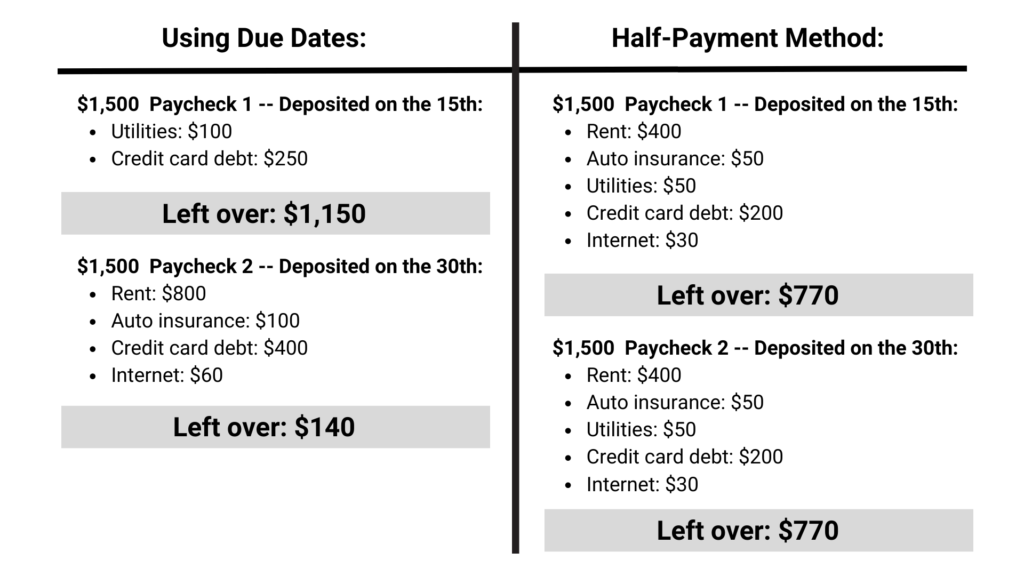

Let’s take a look at an example:

Laura makes $3,000 a month. The minimum monthly payment on her credit card debt is $250. She wants to pay $400 each month to pay it off faster.

Her other bills:

- Her portion of Rent: $800 (1st of the month)

- Auto insurance: $100 (due on the 10th of the month)

- Utilities: $100 (due on the 15th of the month)

- Credit card debt: $250 (due on the 20th of the month)

- Internet: $60 (due on the 1st of the month)

Using the half-payment method, Laura is able to reduce the burden on her second paycheck, make larger payments toward her debt, and have more breathing room in her budget.

So how do I implement this?

The first step is to look at your monthly income and all fixed expenses. You will need to create a simple list including due dates (similar to the one above). You can lay this out on a calendar if you’re a more visual learner. Review the last three months of expenses to ensure you don’t miss anything important. Once you have your list with due dates, play around with splitting your fixed expenses. It’s okay to pull out a calculator, sticky notes, or any other tools that will make this process easier.

From there, you can better budget by paycheck, set up automatic bill pay and transfers, or set up reminders in your calendar to make your half payments twice a month. Whatever works best for you and your brain.

If you can not make more than one payment per month (such as certain utilities or memberships), hold the funds in a separate checking or savings account, and set up automatic bill pay from there.

You may also consider calling your credit card company, utilities, insurance, and other companies to move your due dates. YES – this is totally a thing you can do! Let them know moving the date (say from the 20th to the 30th of the month) will make it easier for you to pay in full each time. If the first person you talk to says “no”, it’s okay to call again and see if another customer service representative will say “yes”.

Anything else?

The half-payment method can be a great tool to streamline your finances. It does require getting to know your real numbers, which can feel scary. It’s important to remember that you don’t need to like your real numbers for them to be helpful to you.