The words we use around money are powerful.

Unfortunately, a common word tied to finances is extremely toxic, but also impacts nearly all of us.

“Should”.

We tell ourselves: “I should go open an emergency fund”, or “I ought to email HR and update my retirement contributions”, or “I know I should be saving more money”. But the days, months, and years pass where nothing changes and we feel worse about ourselves.

Here’s the funny thing about “should” – it’s filled with judgement, shame, and guilt. Constantly telling yourself what you “should” be doing with your money only leads to more feelings of frustration without any forward momentum.

So how do we stop “should-ing” ourselves?

Here’s a simple exercise to help you get past “I should” and move to “I will” when it comes to your money goals:

1. Grab three sheets of paper.

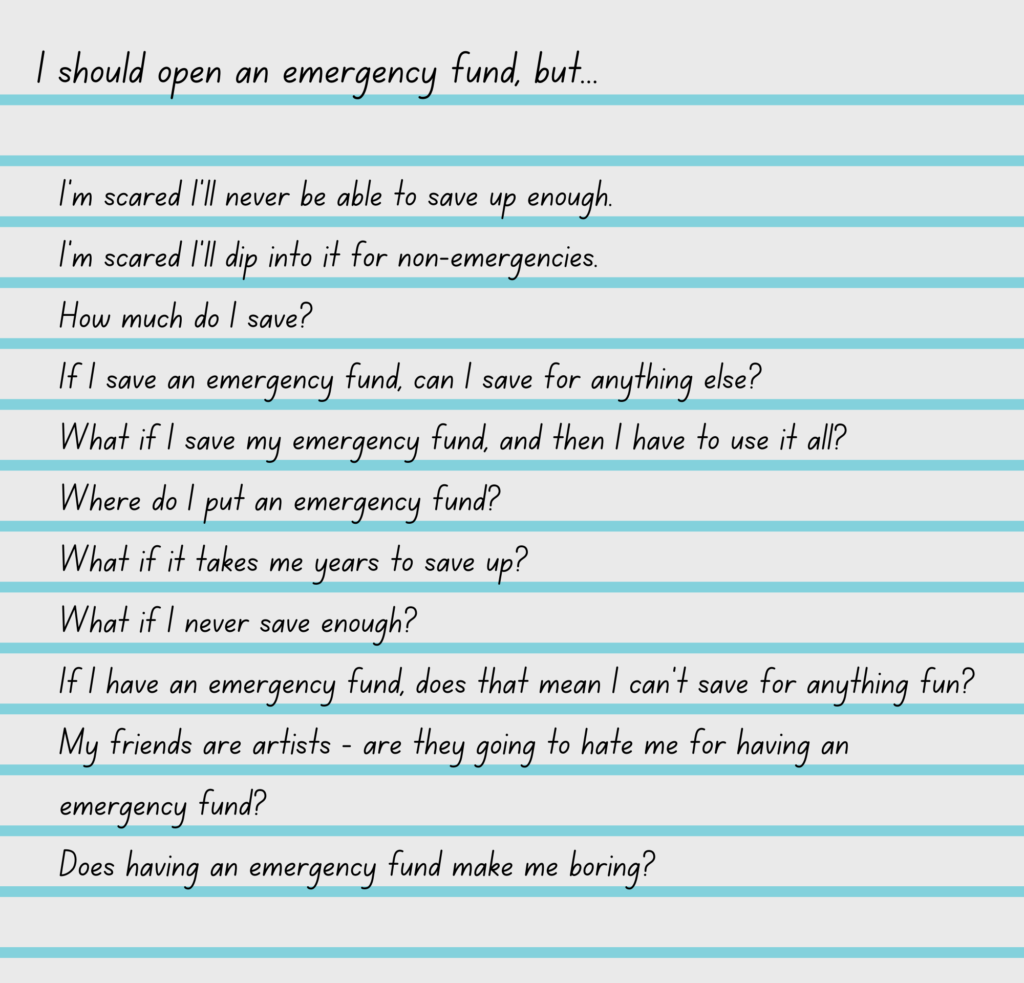

2. On the first sheet, write out all your financial “shoulds“. Get it all out – everything your mind can think of. It will probably look something like this:

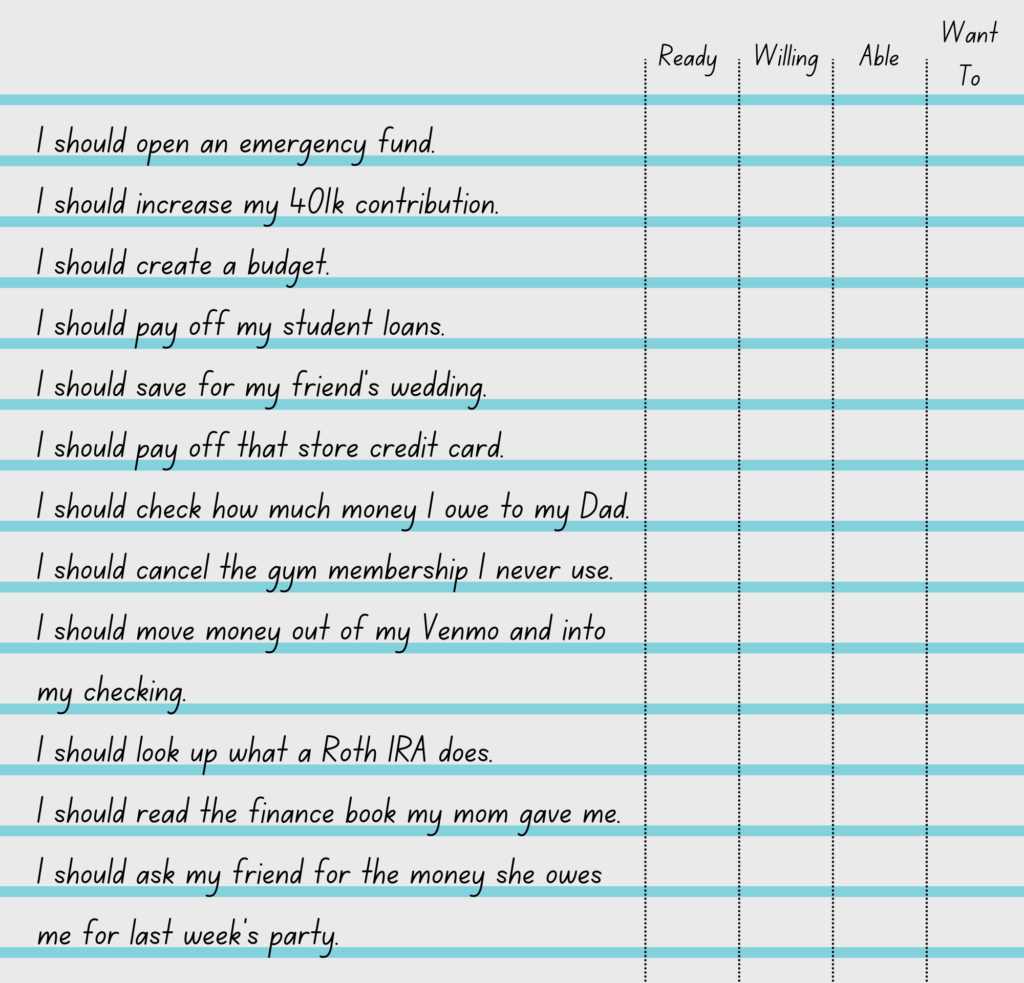

3. Once your “should” list is done, add four columns:

- READY (How ready are you to tackle this item on your list? Do you have the resources you need to take action, such as time/skills/information?)

- WILLING (How willing are you to take action?)

- ABLE (Do you feel confident that you could take a small step forward on this?)

- WANT TO (Is this important to you? Do you have the motivation to do it?)

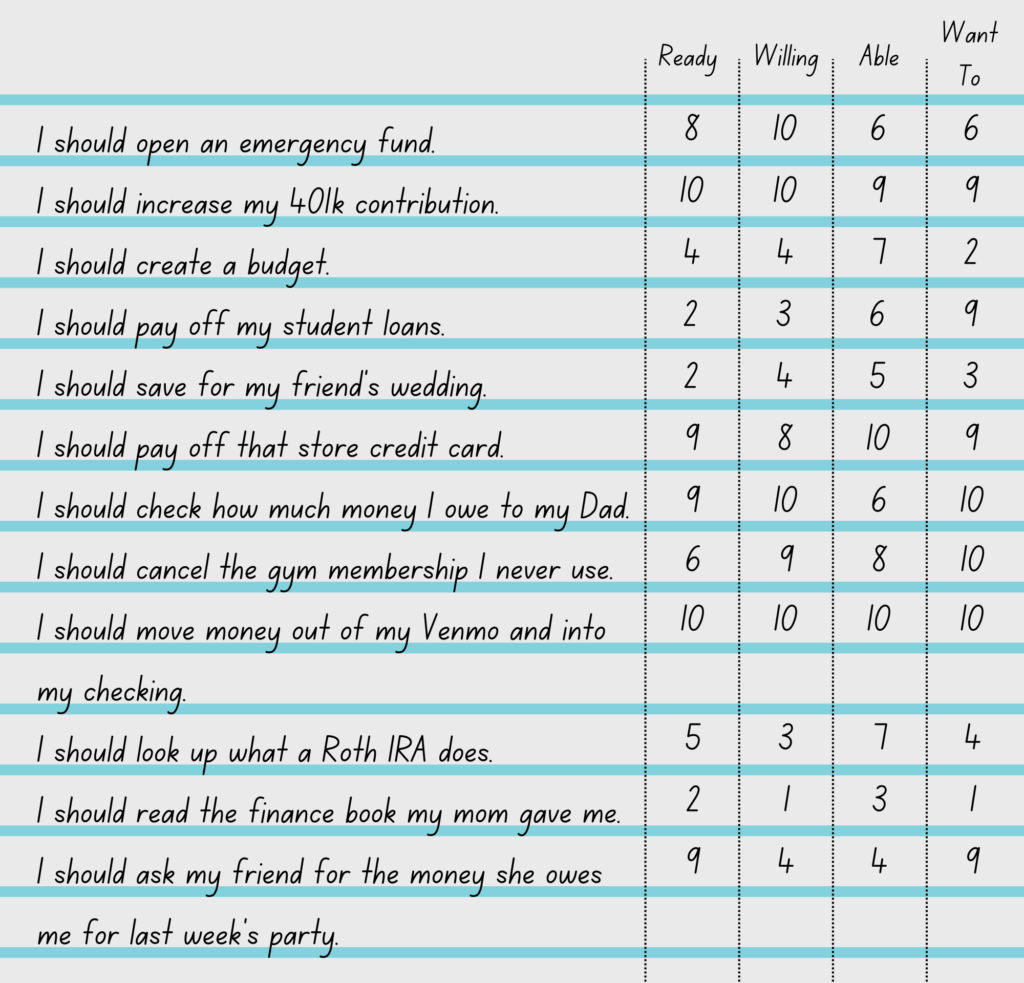

4. For each column, rank your response 1-10, with 10 being the highest score for each question. BE HONEST. Respond with your genuine first instinct – no one else is going to see this, and there is no “right or wrong” answer. You may end up with something like this:

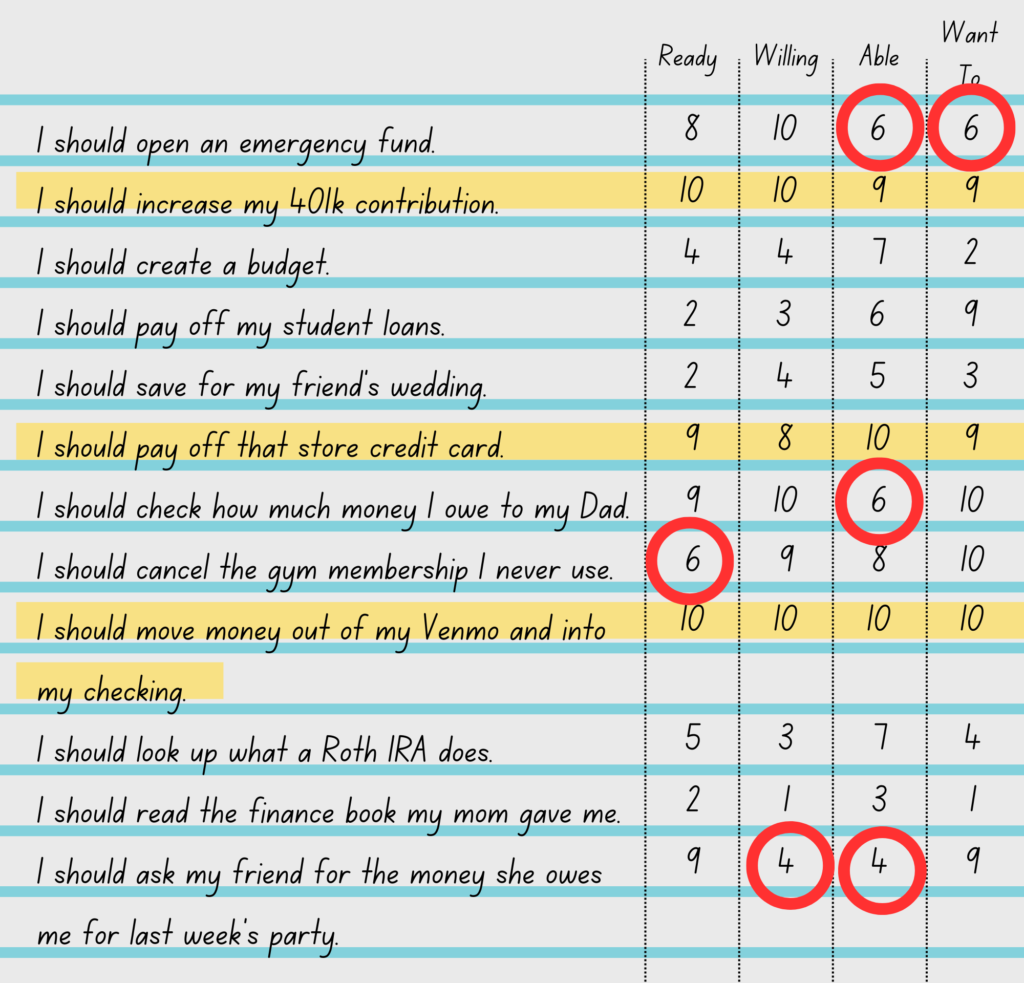

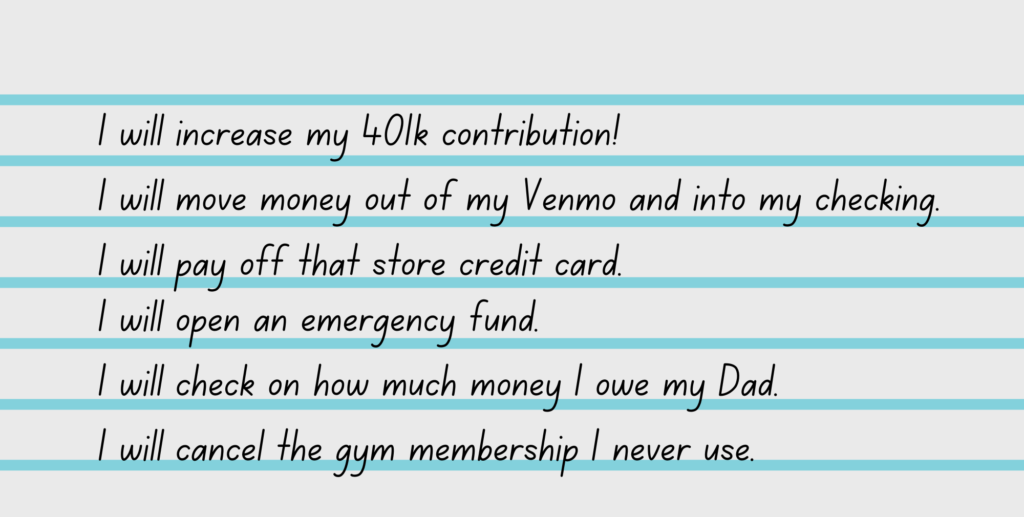

5. What we’re looking for is responses with 8 or above in all categories. Highlight them. Then re-write them on the second sheet of paper, replacing the words “I should” with “I will“. Add these tasks to your calendar or to-do list, and find a way to celebrate it getting done! No more should on these!

6. Next, circle the items where you had mostly 8 or above, except in one or two categories. These are items where you probably have some limiting beliefs.

7. On the third sheet of paper, you will journal about these “should” statements . Write out the reasons you are are not ready, willing, able, or want to take action on the circled “should” item. No matter how illogical it may sound, write out your reasoning. The key to this part of the exercise is to become curious about your thoughts, beliefs, and emotions for why you feel you “should” be taking action, but have not yet. Do this for each “should” statement that you circled.

8. The great part about page three is that it allows you to come back with fresh eyes. These reasons have been blocks on your pathway toward action. The good news is that reviewing these blocks allows you to see ways to move them from your path so that sustained action is possible.

In the example above, you can see some of these reasons simply require more information (such as, “Where do I put an emergency fund?“) and helps you to know what to research.

Others are based in stories we have about money (such as “My friends are artists – are they going to hate me for having an emergency fund?” and “Does having an emergency fund make me boring?“). This is an opportunity to get curious about your money beliefs, and ask yourself how true or helpful these beliefs are. This is where a money mentor or therapist can support you exploring these beliefs more deeply.

Once you have reviewed your blocks, you may be ready to add them back to page two, and transform those “shoulds” to “I will” statements. These kind of statements are about empowerment and action.

What about the other “shoulds”?

For statements on page one that are ranked low across the board, this is where you might need to let some “shoulds” go; mentally calling a truce (even if it’s only for today). Give yourself permission to mentally let go of these “should” concepts and stop beating yourself up about it.

In the example, the lowest ranking “should” statement was “I should read the finance book my mom gave me“. While it might be worthwhile someday to explore all the reasons you aren’t ready, willing, able, or want to take action, here’s the harsh truth: you will never feel shamed enough to take action on this one. Therefore, it is okay to release yourself from others’ expectations. (Sorry, mom.)

Ready, set, go.

When it comes to your finances (or anything else for that matter), you cannot “should” your way into taking sustained action. Bringing awareness to our “shoulds” and transforming them into “I will” is about creating freedom. If you found this exercise helpful, share your thoughts with me on Instagram.