“I’m my own worst enemy.”

When a client shares that they aren’t meeting their financial goals, they often talk about self-sabotage. They describe their behaviors and choices like a small gremlin in their mind that is actively working against their best interest and they are powerless to stop it. The cycle of financial self-sabotage is common and takes time to work through, but there is hope!

What does financial self-sabotage look like?

If you have money goals (saving, investing, paying off debt, etc.), but continue to overspend or never take tangible action, there’s a good chance you’re falling into the trap of self-sabotage. Let’s look at a few examples:

- Amelia is drowning in credit card debt but continues to order food delivery most nights.

- Caleb wants to put money away for emergencies, but each month passes and still hasn’t opened a high-yield savings account.

- Rachel got a raise six months ago and promised herself she’d start investing. Unfortunately, her spending increased right along with her paycheck, and she’s still living paycheck-to-paycheck.

- Sam hates getting slapped with late fees, but always forgets to pay his utility bill on the 1st of the month.

- Trish puts money aside each month but inevitably dips into her savings to cover her impulse online shopping.

It’s hard to admit to ourselves when we are self-sabotaging. Even if we are aware of our behaviors, we may not understand the underlying causes.

Why do I self-sabotage?

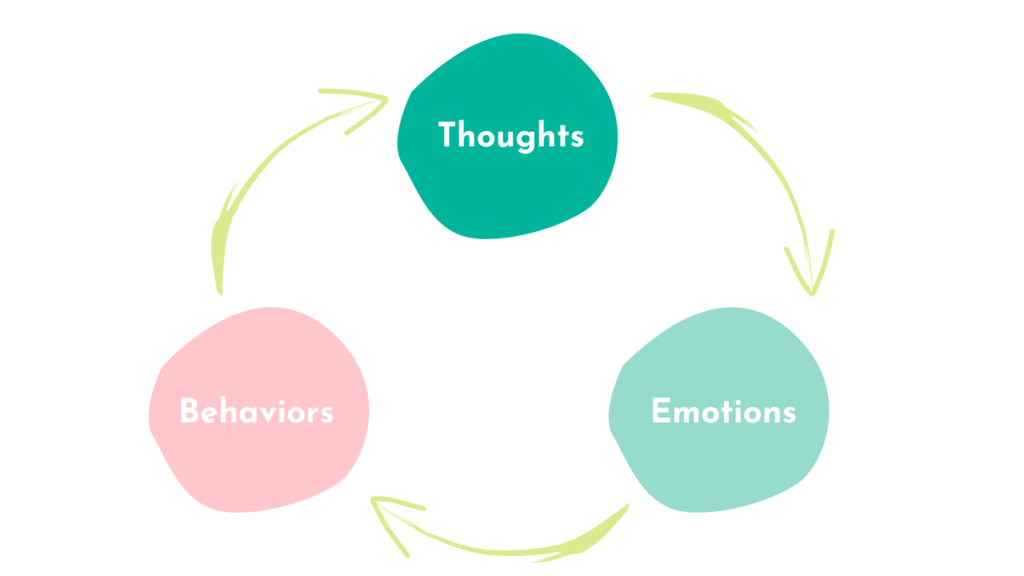

More often than not, there are a few factors at play that keep us trapped in the cycles of self-sabotage. It’s critical to note a basic principle of psychology: our behaviors, emotions, and thoughts are inextricably linked. This means that behind every action (or inaction), there are feelings and thoughts that are brewing behind it.

Here’s an example of the self-sabotage cycle in action:

Gina comes home after a long day of work, plopping down on the couch with a glass of wine. “How does anyone cook dinner after the kind of day I had?” she thinks. She opens a food delivery app on her phone and starts placing her order. A pang in her stomach knows she has food at home, and she’s wasting so much money on this – money she could be putting toward the overdue maintenance on her car. “What does one night of takeout matter?” She presses the PLACE ORDER button with a twinge of guilt. She’s failed to keep her promise to herself…again. Why bother even promising herself that she’ll change?

What thoughts and feelings are behind Gina’s behaviors? In what ways is she self-sabotaging?

Learning to identify our financial behaviors, then the feelings and thoughts we have around those behaviors is an essential step to stopping the ways we undermine our progress. Let’s take a look at a few of the emotions and thoughts behind common self-sabotaging behaviors:

- Fear of discomfort. We get comfortable doing the same things over, even when those choices are ultimately harming us. For example, we put off investing for retirement because we fear it would mean losing out on fun and excitement now, or we “forget to save” and rely on credit cards to get through emergencies. Fear of discomfort isn’t about being lazy, entitled, or privileged – it’s about our unease with vulnerability. Pushing ourselves outside of our comfort zone to save, invest, and learn about personal finance is important AND challenging. Being temporarily uncomfortable and vulnerable isn’t a bad thing. Most often what we want is just outside our comfort zone.

- Listening to our inner critic. Is there a part of yourself that has something negative to say about any goal you have? Maybe it says things like “it’s too late to try”, or “you’ll never save that much money”. Our inner critics can be cruel and loud. When we are trying something new (like paying off debt), and make a mistake, it’s easy to believe our inner critics – particularly if they sound a lot like an authority figure from childhood.

- Your stories about money aren’t fact-checked. The beliefs we have about money cannot be detached from our financial behaviors. If you think money is “evil” or “bad”, you’re probably not going to save or invest it. If you are terrified of “losing it all”, there’s a good chance you’re not going to improve your financial situation (it hurts less to fall from a lower step than the top of the stairs). This can be generational too – more and more young people believe they’ll never be able to retire, and therefore decide it’s pointless to save for their old age; even if they are financially capable of doing so.

- Fear of failure and perfectionism. Perfectionism says, “If I can’t save the max amount each year for retirement, I shouldn’t bother trying”, or “I have to make way more money to pay off my debt at lightning speed. Until then, it’s not worth trying.” Most of the time, perfectionism is masking a fear of failure. We hold ourselves to impossible standards, and so get caught up in the details we never take tangible steps forward.

- Detachment from consequences. Why save for an emergency when everything is hunky-dory right now? Why invest for retirement when that’s decades away? Why bother paying off your credit cards when no one is pounding down your door for the money? When we make choices that undermine our financial goals, we often don’t feel the pain of consequences right away. Instead, we feel them when it’s far too late; e.g. panicking when our car breaks down and we have no savings to cover the repairs, having to work far longer than our bodies can because we didn’t save for retirement, or facing thousands of dollars extra in interest because we only paid the minimums on our credit cards.

It’s important to note here that self-sabotage is often layered and multifaceted. If you know you are self-sabotaging, bullying yourself about this behavior will only make it worse.

What can I do to stop financial self-sabotage?

Question the stories you have about money. The stories you have about money – whether you’re conscious of them or not – will directly impact your financial decisions. This is where working with a money mentor or therapist can be extremely helpful. When you recognize a thought pattern about money (e.g., “I’m bad with money”), ask yourself why. Dig deeper and deeper, and continue asking that same question: why? Journaling this activity can also help you untangle the stories you’ve created about money, or picked up along the way. Fact-check the ideas you have about money – there’s a good chance you’ve been lied to by your own brain!

Automate! Self-sabotage is a lot easier if you’re doing everything manually. Automate whenever and wherever you can to save, invest, and pay off debt. If your employer offers direct deposit, you can have a percentage of your paycheck directly deposited into your savings account (I recommend an account that is at a different bank or credit union to avoid the temptation to spend it). Set up automatic transfers to your savings accounts through your bank based on the days you get paid. Schedule payments with your creditors and around your pay dates. Then, set a calendar alert to check in on your automated transfers so there are no glitches.

Create your own speed bumps. Today’s technological advances make self-sabotage a lot easier. If getting up from the couch to get your wallet will make you think twice about “adding to cart”, remove your credit card details from online accounts. A favorite way to slow down in-person spending decisions is to move the item you’re thinking of purchasing (say, that cute candle at Target) to a shelf in another aisle. Does it still have the same appeal? Do you have one in a similar scent/color/size? Where will you put it when you get it home? Sometimes moving the item you’re considering buying to another location can help slow down your decision making, which can help you avoid impulse spending.

Build your confidence with low-risk experiments. Sometimes our negative beliefs need a teeny bit of evidence to prove they’re wrong. You can create your own evidence by conducting small, low-risk experiments. For example, if you are anxious about saving because you have a belief that “money is meant to be spent”, try a tiny savings challenge – I mean REALLY tiny. Put $1, or $5 a week into a savings account. At the end of the month, ask yourself how it feels to know you were able to save. Were you tempted to move it back to your checking account? How might it feel to increase your savings to $10 or $20 a week? What evidence do you now have to show that you are capable of saving money?

Have comebacks for your inner critic. When your inner critic tries to bully you into self-sabotage behaviors, having responses ready can be a powerful way to fight back with a growth mindset. For instance, when your inner critic says, “you’re too stupid to learn about money”, respond with “I may not know much about money yet, but I am learning.” Practice telling yourself the things you would say to a friend who is also attempting something challenging – and start saying them to yourself. You are worthy and deserving of self-compassion.

Learn from your spending triggers. We all have them…those pesky little urges that make you spend money in regrettable and forgettable ways. But there are tricks to deal with them in a healthy way.

Make your financial vision tangible. Let’s say you want to save money for travel. That’s not a particularly inspiring goal when your friend invites you out for happy hour for the third time this month. But if you have a strong vision (“I am saving to go to Italy next year and toss pennies into the Trevi fountain”), it’s a lot easier to pass on a night of overpriced cocktails and cold-in-5-minutes appetizers.

Final Thoughts

Falling into the trap of self-sabotage doesn’t make you a bad person or a failure. This is a common experience for those just starting their personal financial journey and can be made worse by mental health conditions, neurodiversity, and trauma. If you need support, it’s okay! Self-sabotage is a heavy burden that will slow down or halt your progress. Get curious about the causes behind your self-sabotage, and get creative in supporting your vision for a better financial future.

Liked this post? Be sure to share it!